GST Collections and Tax Revenue Growth Highlighted for FY 2026-27

Union Finance Minister Nirmala Sitharaman is going to present her speech on 1st February 2026 (200070001001) on 20th November 2020. The budget will focus on the humanity of India, the world's fastest growing economy, where poverty alleviation, fiscal consolidation and infrastructure push will be a key focus. The Finance Minister started the tradition of writing 'Bahi-Khata' in 2019. The rate of subsequent rains will be the same as the budget.

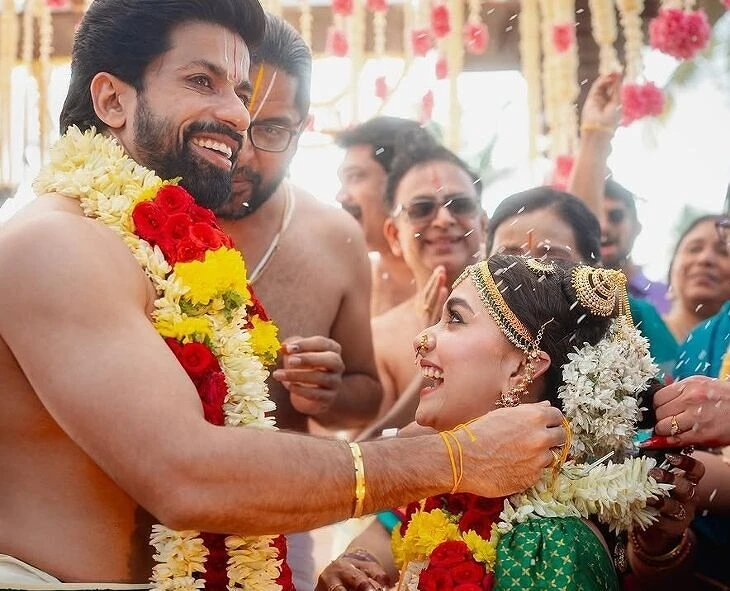

-appearance-

Famous figures who are very important

Ahead of the Budget presentation, the key indicators that markets, investors and economists are looking at per tick are:

fiscal deficit

The fiscal deficit is targeted at 4.4% of GDP in the financial year 2025-26 (in the estimates it is 4.3%).

After achieving the below target of 4.5% in FY 2026, there is a cut in FOC's funding for 2027.

Market expectations: The government is targeting a growth rate of between 4.0% to 4.4% by 2027, with debt to GDP growth being a clear strategy.

capital expenditure

Capex for FY26 fixed at Rs 11.2 lakh crore.

In the next budget, there is a strong possibility of putting more emphasis on infrastructure.

Estimate: Capex is stronger by 10-15% or more and may reach even higher.

Wage revision is due FY28, which will also encourage real investment.

debt reduction framework

Debt to GDP will increase from 2026-27 as announced in the Budget 2024-25.

Total government debt to GDP in 2024 was 85% (Centre's share was 57%).

How is the market interested: Time limit and strategy for government debt reduction after FY27? Target 50% (±1%) by 2030-31

borrower

Gross borrowing in FY26 is fixed at Rs 14.80 lakh crore.

This is a complete reduction of the treasury deficit, which is indicative of revenue collection and growth.

tax revenue

Total Revenue in FY26 is Rs 42.70 Lakh Crore (~11% growth from FY25) Direct Taxes (Tax + Corporate Tax): Rs 25.20 Lakh Crore Customs (GST) Customs, Excise): Rs 17.50 Lakh Crore, will remain in focus till FY27.

GST collection

GST in FY26 at Rs 11.78 lakh crore (11% growth).

Tax cut from September 2025 (GST 2.0) to be collected from FY 27 onwards.

This is a big part of the kingdom, that is why it is believed to be great.

nominal gdp

The baseline for FY26 was 10.1%, but the forecast is lower than NSO's 8.0% GDP growth (GDPD 7.4%).

The government is currently projecting 10.5-11% nominal GDP growth for FY27, indicating a higher trend.

Other major focus areas Social Sector

Provision for schemes like health, education and village G.

Regional priorities: conservation, renewable energy, manufacturing, employment generation and rural development.

Overall, this budget growth and fiscal discipline will continue to balance the balance, while the Hong Kong push will continue, but the focus will remain on deficit control.

Comments