Hindustan Unilever fined in Vaseline case

While hearing a case related to Hindustan Unilever, the Delhi High Court has said that people should get the benefit of reduction in GST rates. The court clarified that price reduction is necessary. Increasing the product quantity while maintaining the old price is not the right way. The Delhi High Court passed this judgment while hearing the petition of M/s Sharma Trading, a distribution company of Hindustan Unilever Limited.

In its judgment, the court said that the main objective of reducing GST rates is to bring goods within the purchasability of common people. As such, its purpose will be fulfilled only when its prices are reduced.

What is the matter?

After the change in GST rates in 2017, the tax rate on Vaseline was reduced from 28 percent to 18 percent. However, Vaseline kept its product prices intact. Instead of reducing the price, the company increased the quantity of its product. Along with this, the base price has been increased to Rs 14.11 per unit. As such, the National Profiteering Authority in 2018 imposed a fine of 18 per cent interest on the firm and ordered it to deposit Rs 5,50,186 in the Consumer Welfare Fund. The firm filed a petition against the order, which was dismissed by the court and the penalty was upheld.

What did the High Court say?

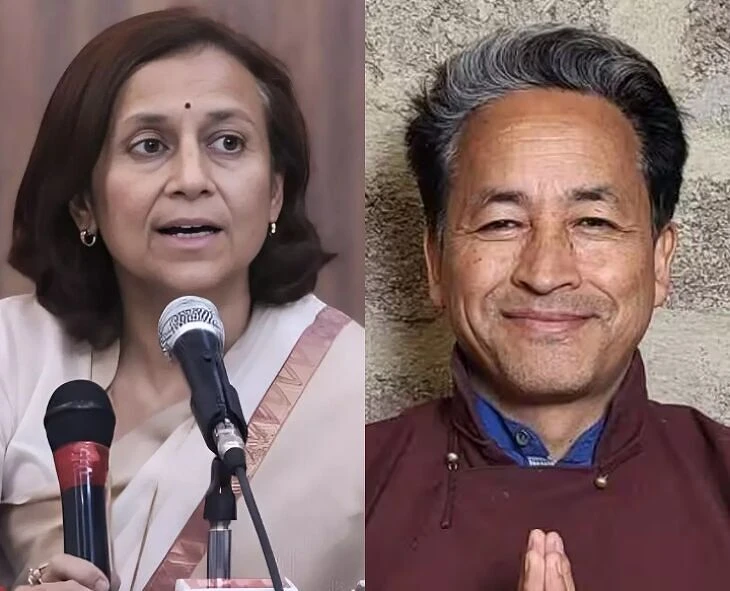

Delivering the judgment on September 23 (Friday), a bench of Justice Pratibha M Singh and Justice Shail Jain said that the basic objective of the cut in GST rates is to make goods and services more affordable for buyers. Such methods defeat the purpose of deduction in GST. This amounts to fraud and limits the consumer's options. The decision is significant in the wake of major changes in the tax structure by the GST Council, effective September 22, 2025, from a multi-slab system to two main rates, 5% and 18%, and a rate of 40% for luxury/impure goods.

Comments